You might see reference to "days" versus "terms" in reference to working capital.

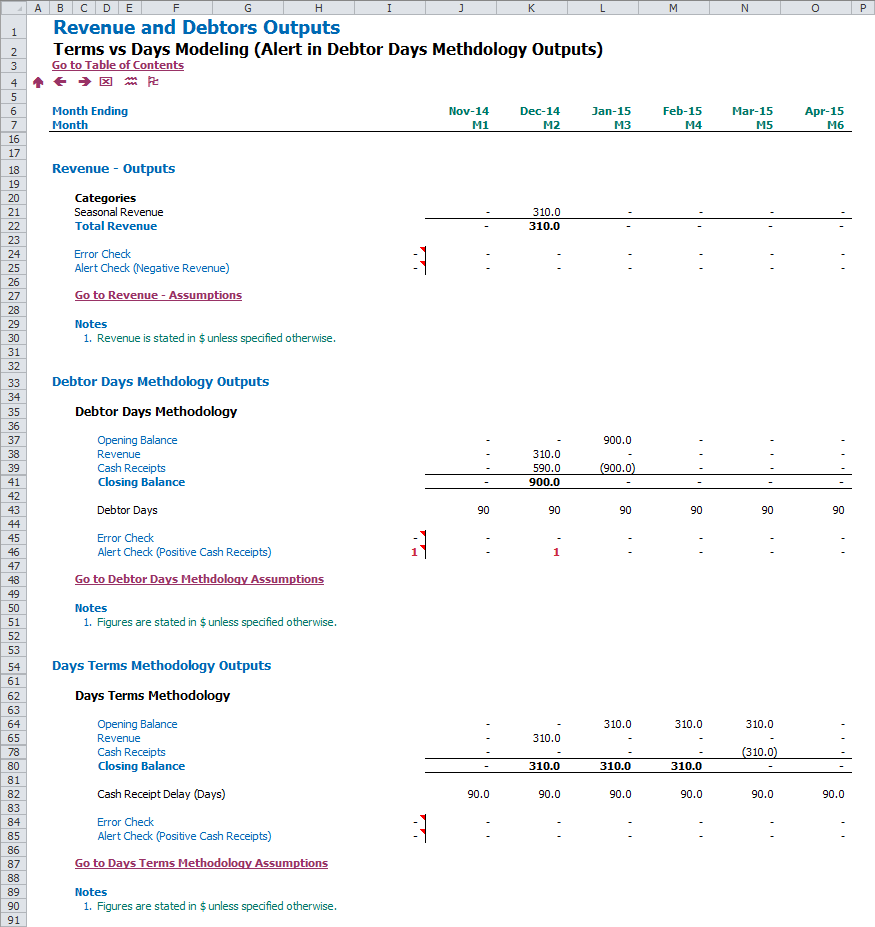

The following example illustrates these two main approaches to modeling working capital side-by-side. This applies to any working capital but for simplicity has been illustrated here using revenue and trade debtors.

The Debtor Days methodology is employed by the vast majority of modelers, typically using the following calculation steps:

- The amount of revenue for each period of modeling is converted to a daily amount.

- The forecast debtor days assumption is multiplied by this daily amount to determine the closing debtor balance.

- Finally, the cash receipts for the period are calculated as the balancing figure.

The debtor days methodology has the benefit that it is simple to construct and the logic is easy to comprehend. The issue with the approach is that it does not work so well with either seasonal businesses or in instances where the cash receipt period is longer than the model periodicity.

This can be seen in the example (see below) where there is a single month of $310 revenue in Dec-14. Using the debtor days methodology the $10 per day of revenue calculates a closing trade debtors balance of $900, based on a 90 day assumption. This then implies positive cash payments of $590 as a balancing figure, i.e. we are giving our customers money (as indicated by the triggered alert). Finally, with no revenue in Jan-15, the 90 day assumption then creates a zero closing trade debtor balance, leading to all the cash being forecast as being received.

The Debtor Terms methodology resolves these issues by modeling the specific receipt of each period of revenue on the terms at which it was sold. In the same example, the $310 of Dec-14 revenue is made on 90 days terms, so the modeling matches this revenue (entirely) forwards into the Mar-15 column.

The benefit of the approach is that the cash flow modeling is extremely accurate and will reflect all the subleties that come with highly seasonal businesses, monthly, weekly or even daily cash flow analysis, as well as accurately modelling any planned movement in working capital terms.

The main issue with the approach is that it is complex. It's not necessarily complex to understand - any accountant can comprehend the key output lines and that the correct calculations are used. The complexity arises more for the modeler during construction. But that's why we gave you an example file to pick through...

If you've got any questions or alternative ways of modelling working capital then hit me up!

Note: the first "BPM-Days vs Terms Modeling.xlsb" file is also a dynamic Modano file, so Modano users can add additional revenue and trade debtor categories as normal.

Thanks James, this topic was posted 4 years ago but still helpful when it comes to working capital modeling. Accordingly, "terms modelling" is powerful.

I just have a question. In your example, assuming customers will be allowed to pay $310 Dec-18 revenue after 100 days (instead of 90 days), the module showed the result that cash would be received in Mar 2019 ($210) and in Apr 2019 ($100). I understand it might be because we are not sure the exact date in Dec 2018 on which the sales were made, then a fixed date of the sales in the month was assumed to estimate the cash receipt?

However, if the revenue was made on 31 Dec 2018, $310 should have been fully received in Apr 2019 (instead of being paid in two tranches in Mar and Apr 2019). How can it be revised to reflect the fact that the revenue was made on 31 Dec 2018 and cash would be fully received in Apr 2019 in the terms modeling module? Your help is really appreciated.

Hi Hoang. That's correct, the modules assume constant daily invoicing, so the $310 would be split into daily invoices of $10.

If you have more specific invoicing timing, then these would need to be modelled more specificallly.

It might be worth looking at the Daily Example Model as this handles a lot of these nuances:

Hi James, it is noted with thanks. I will look at the daily cash flow model then.

Hi James

Thank you for the above information and sorry to bring this back after so long. I was watching the Working Capital video and saw you have a receipts profile module for debtors (in the attached snapshot), but cannot find it in the online module library. Has this module been retired?

Thank you so much.